Submitted by Frank Macey on

Apple Pay has nudged out its competitors in a head-to-head contest at the offices of Consumer Reports. Despite the fact that Apple Pay is only available on Apple devices, it scored higher in several categories that Consumer Reports designed to "help people make informed choices". Apple Pay took top honors overall in the ratings, which focus on data privacy and security.

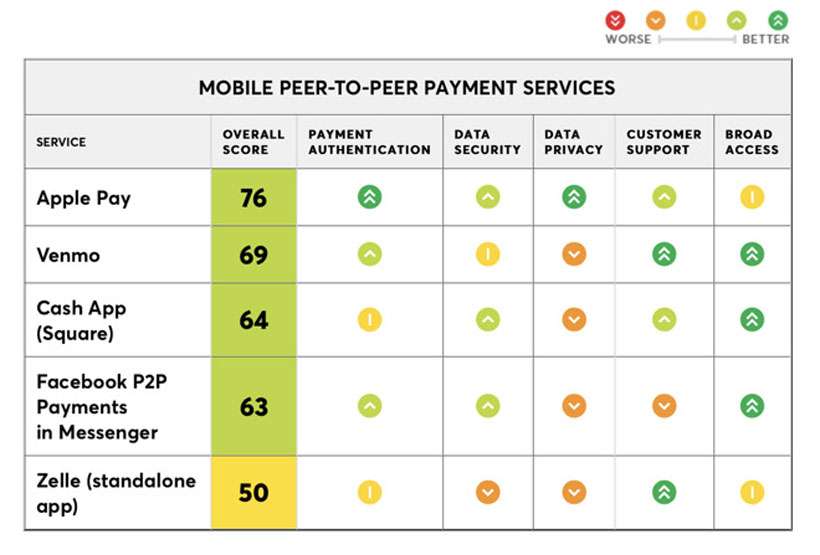

With over 79 million US residents using P2P payment services this year, the popularity of these services continues to increase. Consumer Reports came up with the following total scores:

| Apple Pay | 76 | |

| Venmo | 69 | |

| Cash App (Square) | 64 | |

| Facebook P2P Payments in Messenger | 63 | |

| Zelle (standalone app) | 50 |

Factors such as "how well the services authenticate payments to prevent fraud and error, secure user data, and protect privacy" were front and center, however Consumer Reports also checked out customer service items such as support for issues, disclosure of fees and whether or not P2P services required mandatory arbitration. While Apple Pay beat the competition in both the Data Privacy and Payment Authentication categories, the lack of broad access lowered its overall score.

For now, those looking for a cross-platform solution can look to Venmo and Square's Cash App for top-performing P2P payments services that also work outside the Apple ecosystem.